Are Wages Payable A Liability

Definition: Wages payable is a current liability account that records the corporeality of wages that are owed to employees for work that was performed by the employees in prior periods. In other words, wages payable is the corporeality of wages that employee hasn't paid the employees for their work.

What is Wages Payable?

The wages payable account is unremarkably used at the terminate of a period like a year-end. Many times the end of the twelvemonth doesn't autumn exactly at the cease of a payroll period. For instance, assume employees are paid every Friday and December 31 lands on a Tuesday. This means that at the beginning of the next twelvemonth, January 1, the employer owes the employees two days worth of pay for the Monday and Tuesday worked in Dec.

Example

Since the employer pays the employees on Fri, these employees volition take to wait until January three to become their full December wages. At the finish of Dec, the employer owes the employees ii days worth of pay, then information technology has to record that liability in its accounting system and present it on its financial statements.

How is Wages Payable Recorded?

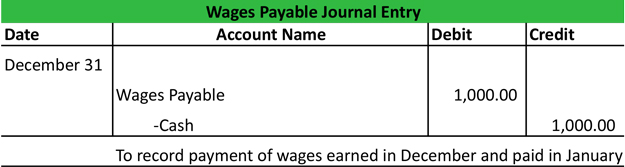

On December 31, the employer simply debits the wage expense and credits the wages payable account for the Monday and Tuesday wages. Here is the wages payable journal entry.

Afterward in January when the wages are paid, the employer would debit the wages payable business relationship considering the wages are no longer owed to the employees and credit the greenbacks account for the amount of greenbacks paid to the employees.

Contents

- i What is Wages Payable?

- two Example

- 2.ane How is Wages Payable Recorded?

Are Wages Payable A Liability,

Source: https://www.myaccountingcourse.com/accounting-dictionary/wages-payable

Posted by: paintersonch1974.blogspot.com

0 Response to "Are Wages Payable A Liability"

Post a Comment